Award-winning PDF software

Get independent business owner cancellation form

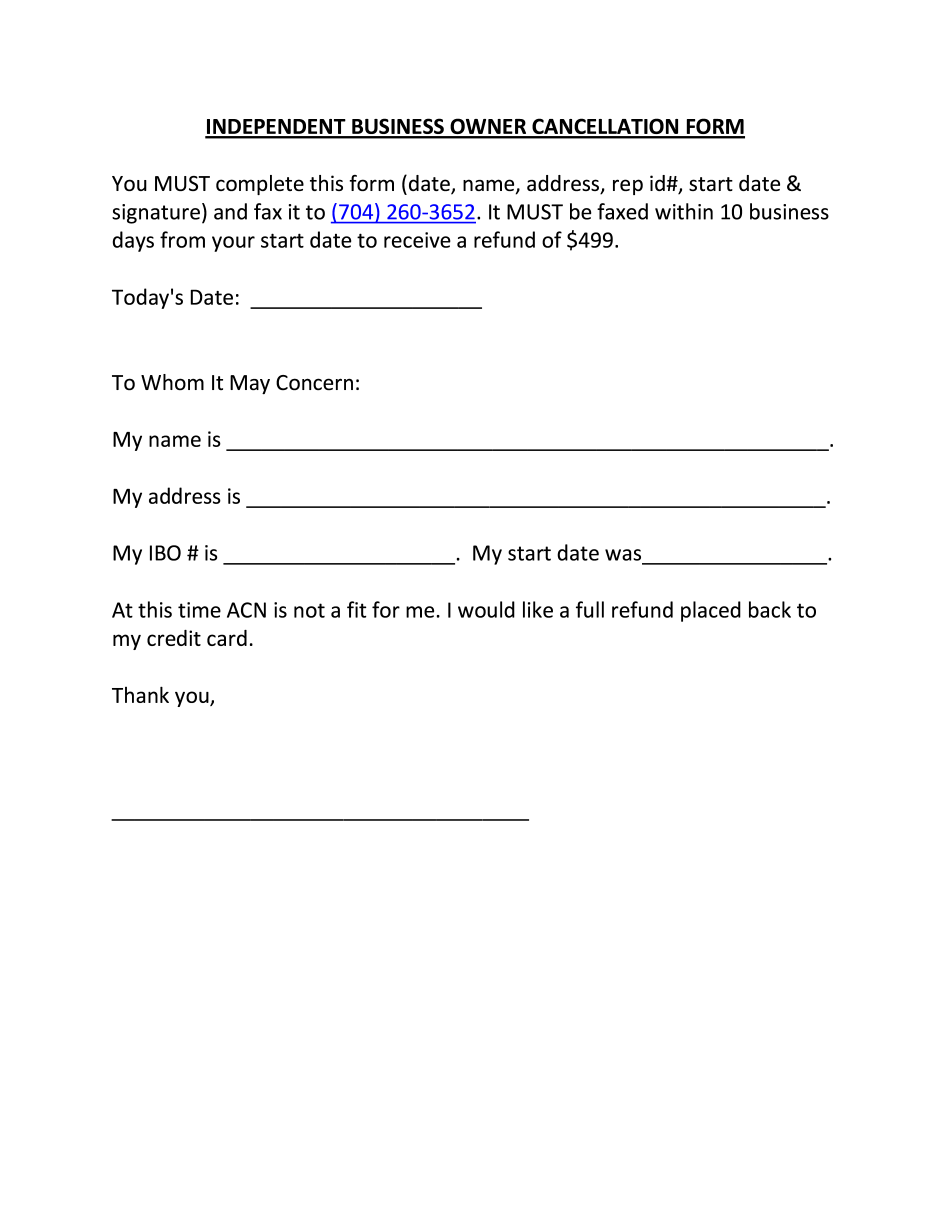

The information provided will also show any potential court or other legal consequences of the cancellation, and make your paperwork much easier to read and complete. In the event you have any legal issues with a customer (such as a lawsuit), or if you have a question or problem with your paperwork, let our independent law clerk/lawyer in our office be your first point of call for any legal questions. Call us today to request an Independent Business Owner Cancellation Form. Fill out your cancellation forms online You will need two forms: Independent Business Owners Cancellation form (Optional) The cancellation form must include a complete and correct name, and address. You must also include the business name, address, and fax number of the business to which you are cancelling. In addition, we recommend that you include on the form your business license number. The cancellation information also needs to specify when you plan on closing for.

How to cancel acn ibo membership - fill online, printable

The number to call is. We cannot process cancellations due to tax. CUSTOMER SERVICE (for the return): If you would like to cancel your current reservation, please go straight to Customer Service. It will take you directly to the Customer Service location: Please note that we don't receive cancellations unless we receive your request, so please be prepared to wait before your reservation is activated again. If you would like to cancel your current reservation, please go straight to Customer Service. It will take you directly to the Customer Service location: If You do not provide a name and address, we can't process your cancellation. You will receive a confirmation e-mail stating that your reservation is cancelled. Please check the status of your reservation (you are logged in, but not able to edit your reservations). If there are no changes in your reservation (you didn't click Cancel in the status line), then this.

Get and sign acn cancellation form - signnow

Search & Compare The best place to search and compare costs worldwide. ACN Compare gives you access to millions of prices in a single search result. Register now, or call 1300 853 247. ACN Compare The most effective way to compare costs in your local area. Register in seconds. Reviews Review ACN Compare Now and enjoy a review from our expert and friendly customer service staff on your new account. We take pride in delivering friendly and quality services, and our customers love it! Join Now ACN Compare is proud to be your trusted supplier of online cost comparisons. Register now, or call 1300 653 243 to see how easy it is for you to compare prices in your area, and get instant access to all the best savings online. You might also like to read our Customer Services Page.

Independent business owner agreement - wealth

What is a IBO? An Independent Business Owner is an individual or entity who receives financial compensation from the sale or lease of tangible personal property such as land, building, equipment, supplies and labor. All IBO's must comply with the laws of a jurisdiction where they have established their business. This may be a corporate entity, a state agency, or a local governing body. There are now more than 160 States with laws that cover Independent Sales of Motor Vehicles and their related supplies. The laws vary depending on the jurisdiction. A list of the current states is provided below. All the links are for informational purposes only and are subject to change at any time. It is highly recommended that you contact your State legislature to discuss the laws that apply. Most State laws that deal with independent sales of motor vehicles are not applicable to IBO Businesses..

Independent business owner agreement - acn compass

Is not a resident of the. State of Nevada. If I am located outside of Nevada when I apply to become an. Independent Business Owner, the state of Nevada shall provide for the payment of the state's personal or corporate income tax at the applicable rate. (5) A Nonresident Foreign entity, Incorporated Business Entity or a Foreign Organization that is not a corporation. ?. Does not qualify as a domestic corporation under 18 ?5081 (a), (b), (c), (d), or (f) unless it is one or more of the following: Any Nonresident Foreign Entities, Incorporated Business Entity or Non-Corporation formed solely for foreign operations and is not one or more of the other categories described above. Any Foreign Organization formed wholly or part-and-parcel for foreign operations. Any foreign private organization, other than a foreign private organization formed pursuant to law specifically for the foreign operations of a bona fide domestic private.